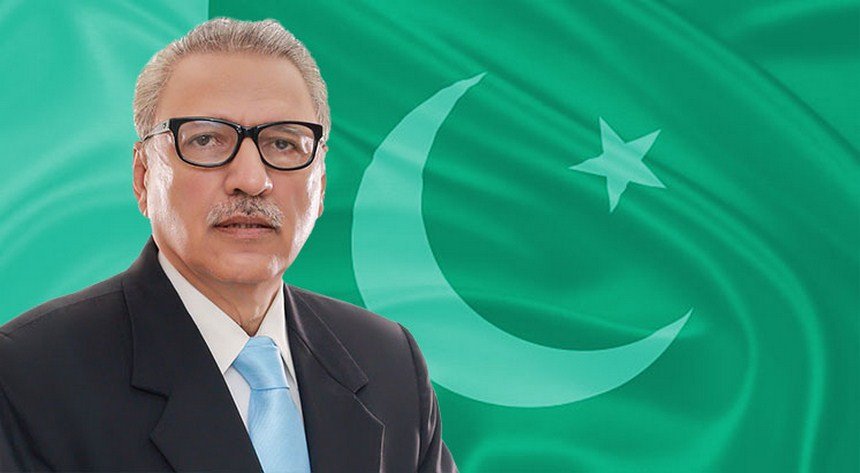

ISLAMABAD: Since the Senate and the NA are not in session and the President of the Islamic Republic of Pakistan is satisfied that circumstances exist which render it necessary to take immediate action, in exercise of the powers conferred by clause (1) of Article 89 of the Constitution the President Dr. Arif Alvi has promulgated the following Ordinance:

1. Short title and commencement.— (1) This Ordinance may be called the Tax Laws (Amendment) Ordinance, 2020.

(2) It shall come into force at once.

2. Amendment in Finance Act, 1989.— In the Finance Act, 1989, in section 7, after sub-section (10), the following new sub-section shall be inserted, namely;─

“(11) Sub-section (1) shall not apply from the date of promulgation of this Ordinance.”

3. Amendment of Ordinance XLIX of 2001.— In the Income Tax Ordinance, 2001 (XLIX of 2001),—

(1) after section 100C, the following new section shall be inserted, namely:- “100D.- Special Provisions relating to Developers and Builders:- (1) Subject to subsection (2), the income, profits and gains of any builder or developer as defined in sub-section (7) and tax payable thereon shall be computed in accordance with the rules in the Eleventh Schedule.

(2) Sub-section (1) shall apply to builders and developers opting to be assessed under this section, on their income, profits and gains from projects which are:- (a) set up between the date of promulgation of this Ordinance and the 31st day of December, 2020; and (b) completed on or before 30th day of September, 2022.

(3) Where this section applies —

(a) the income shall not be chargeable to tax under any head of income in computing the taxable income of the person;

(b) no deduction shall be allowable under this Ordinance for any expenditure incurred in deriving the income;

(c) the amount of the income shall not be reduced by —

(i) any deductible allowance under Part IX of Chapter III; or

(ii) the set off of any loss;

(d) No tax credit shall be allowed against the tax payable under sub-section (1) except credit for tax collected from the builder or developer under section 236K collected after the date of promulgation of this Ordinance on purchase of immovable property utilized in a project eligible under sub-section (2); (e) there shall be no refund of any tax collected or deducted under the Ordinance.

(f) if the tax payable has not been paid or short paid, the said amount of tax may be recovered, and all the provisions of this Ordinance shall apply accordingly.

(4) The provisions of section 111 shall not apply to any shareholder or partner of a builder or developer in respect of any amount invested as capital in a builder or developer or land possessed or acquired by the builder or developer, or its partner in case of a limited liability partnership or in association of persons if,- (a) the amount is invested as capital or the land is transferred on or before the 31st day of December 2020 in the manner as prescribed; and (b) is utilized in a construction or development project under subsection (2) in the manner as prescribed: Provided that the exemption from the provisions of section 111 shall also be available to the first purchaser of newly constructed buildings of a project under sub-section (2) if the purchase is made on or before the 30th day of September, 2022 in the manner as prescribed.

(5) Sub section (4) shall not apply to –(a) Holder of any Public Office as defined in the Voluntary Declaration of Domestic Asset Act 2018 or his benamidar as defined in the Benami Transactions (Prohibition) Act, 2017 (V of 2017) or his spouse or dependents; or (b) Any proceeds of derived from the commission of a criminal offence including crime of money laundering & terror financing but excluding offence of tax evasion.

(6) In this section, “builder” means a single object company or a single object limited liability partnership registered with the SECP or an association of persons registered under the Partnership Act, 1932 during the period starting from the date of promulgation of this Ordinance to the 31st day of December, 2020 with the sole object of construction of buildings and their disposal, and is registered with the Board as a builder; “developer” means a single object company or a single object limited liability partnership registered with the SECP or an association of persons registered under the Partnership

Act, 1932 during the period starting from the date of promulgation of this Ordinance to the 31st day of December, 2020 with the sole object of development of land of any kind either for itself or otherwise, and is registered with the Board as a developer; and “registered with the Board” means registration as prescribed on project-by-project basis on the online portal available on FBR website.

(7) The provisions of the Ordinance not specifically dealt with in this section or the rules made there under shall apply mutatis mutandis to builders and developers so far as they are not inconsistent with this section or the rules made thereunder.”; (2) in the Second Schedule, in Part-I, after the omitted clause (114A), the following new clause shall be inserted, namely:- “(114AA) Any income chargeable under the head “capital gains” derived by a resident individual from the sale of constructed residential property:

Provided that exemption under this clause shall apply if, at the time of sale,- (a) the residential property was being used for personal accommodation by the individual, his spouse or dependents; (b) the land area of the property is does not exceed 500 Sq yards in case of a house and 4000 square feet in case of a flat; and (c) exemption under this clause has not previously been availed by the individual, his spouse or dependents.”; (3) after Tenth Schedule, the following new schedule shall be added, namely:-

“ELEVENTH SCHEDULE RULES FOR COMPUTATION OF PROFITS AND GAINS OF BUILDERS AND DEVELOPERS AND TAX PAYABLE THEREON

1. ELIGIBILITY.– These Rules shall apply to all builders and developers as defined in section 100D.

2. SCOPE AND PAYMENT OF TAX.– (1) Income computed and tax payable thereon shall be on ‘Project-by-Project’ basis under the head ‘Income from Business’.

Tax payable thereon on annual basis shall be computed at the rates mentioned in rule 11.

(2) (a) The above-referred rates shall be applicable for computing tax liability for the project which shall be paid on annual basis. The annual tax liability shall be worked out as under: Tax liability as per the rates mentioned in rule 11

Estimated project life in years (b) The estimated project life shall not exceed two years and six months: Provided that the project is initiated during a period starting from the date of promulgation of this Ordinance to the 31st day of December, 2020: Provided further that the project is completed by the 30th day of September, 2022. (c) Year includes fraction of a year; and (d) The tax liability so calculated and paid shall be final tax.

3. REGISTRATION AND FILING OF RETURN.– (1) All persons registered under this scheme shall submit the registration form along with the irrevocable option to be assessed under this schedule in respect of each project on IRIS through FBR website by the 31st day of December, 2020 or within 30 days of setting up of project whichever is earlier.

(2) A builder or developer availing this scheme shall electronically file a return of income and wealth statement as may be prescribed accompanied with evidence of payment of due tax which shall be taken for all purposes of the Ordinance to be an assessment order issued to the taxpayer by the Commissioner to the extent of income computed under these rules.

(3) Return and Wealth Statement filed may be revised without approval of the Commissioner within sixty days.

4. CERTIFICATION.– Every builder or developer shall be required to obtain and provide to the Board in the prescribed manner a certificate from approving authority or map approving authority or NESPAK, as the case may be, to the following effect:

a) ‘Total land area’, ‘covered area’ and ‘saleable area’ of the project in square foot or square yard b) Such other documents as may be prescribed by the Board.

5. ADVANCE TAX.– Any person falling under this scheme shall pay advance tax equal to one fourth of the tax liability for the year as determined in accordance with sub-rule (1) of rule 2 in four equal installments in the manner laid down in section 147 of the Ordinance.

6. WITHHOLDING OF TAX UNDER SECTION 153 OF THE ORDINANCE.–

A builder or developer shall not be required to withhold tax under section 153 of the Ordinance on purchase of building material except steel and cement: Provided that a builder or developer shall also not be required to withhold tax under section 153 on services of plumbing, electrification, shuttering and other similar and allied services other than those provided by companies.

7. INCORPORATION OF PROFITS AND GAINS INTO WEALTH

STATEMENT.–

(1) A builder or developer shall be allowed to incorporate its profits and gains in its books of accounts which shall not be more than ten times the amount of tax paid under rule (2).

(2) In case the profits and gains of a builder or developer are more than the amount allowed under sub-rule (1), the excess amount shall be chargeable to tax at rates specified in Division I or Division II of Part I of the First Schedule, as the case may be.

(3) Any amount received by a member of an association of person or dividend received in respect of profits and gains of a builder or developer to which sub-rule (1) applies shall be exempt from tax .

(4) Any amount received by a member of an association of person in respect of profits and gains of a builder or developer to which sub-rule (2) applies shall be income of the individual under the head “income from other sources” and chargeable to tax under Division I of Part I of Second Schedule.

(5) Any amount received as dividend in respect of profits and gains of a builder or developer to which sub-rule (2) applies shall be chargeable to tax under section 5 of the Ordinance.

8. MANNER OF EXEMPTION FROM SECTION 111

(1) All moneys to be invested in projects under this schedule for which an explanation of source is not available with the person making the investment shall be put in a designated bank account of the person on or before 31st day of December 2020 and subsequently be drawn for investment expenses.

(2) All moneys to be invested in first purchase of such projects under this schedule for which an explanation of source is not available with the person making the investment shall be put in a designated bank account of the person on or before 30th day of September 2022 and be subsequently paid to the owner of the project through a crossed bank cheque.

(3) A shareholder or a partner transferring land to a builder or developer shall transfer the land at cost as defined in section 76: Provided that no capital gain shall be deemed to arise from transfer of land from a shareholder to a company or a member or partner to an association of persons or limited liability partnership, as the case may be.

(4) A shareholder or a partner making a deposit in a designated bank account under sub-rule (1), (2) or transferring land under sub-rule (3) shall submit a prescribed declaration on IRIS web portal.

(5) NESPAK or a Valuer appointed by the Board shall at the time of completion of project or at any time before completion of the project as directed by the Board certify that all money claimed to be invested in the project has actually been spent on the project.

(6) NESPAK or a Valuer appointed by the Board shall at the time of sale of a completed project, or part thereof, certify the sale price of the project in cases where exemption from section 111 is claimed by the buyer.

9. CHANGE IN PATTERN OF OWNERSHIP OF A BUILDER OR

DEVELOPER BEFORE COMPLETION OF A PROJECT.–

(1) A shareholder or a partner in a builder or developer shall not be allowed to change in ownership of an incomplete project without prior approval of the Board.

(2) In case of hardship, the Board may allow such change in ownership subject to conditions and restrictions as it may deem fit on a case to case basis.

(3) subject to sub-rule (4), no change in ownership shall be allowed by the Board in case where expense less than fifty percent of the total project cost has not been made.

(4) The Board may allow succession to legal heirs in case of deceased shareholder or a partner.

(5) The Board may allow additional partners or shareholders in a builder or developer after the thirty first of December, 2020: Provided that the additional partners or shareholders shall not be eligible for exemption provided under sub-section (4) of section 100D.

10.DEFINITIONS.– (1) In these Rules, unless there is anything repugnant in the subject or context:

(a) “Area” means,-

a. In case of Commercial Building, the saleable area of the building;

b. In case of Residential Building, the covered area; and

c. In case of a developer, the total land area developed.

(b) “Building” includes commercial and residential buildings;

(c) “Commercial Building” includes any building constructed on a commercial plot which may comprise of shops, offices, apartments, penthouses and such other similar structures etc;

(d) “Date of setting up of Project” means,–

a. in case of construction project, when the layout plan is approved by the concerned authority and the construction work starts;

b. in case of developers, when the development plan is approved by the concerned authority; and the development work starts or the scheme is announced to the general public, whichever of the two is earlier.

(e) “date of completion of project” shall mean :-

(i) in the case of a builder the date on which the constructed property is made available for residential or commercial use, as the case may be;

(ii) in the case of a developer the date on which the developed plots are made available for possession to the allottees or transferees.

(f) ‘Low Cost Housing’ shall mean a housing scheme as developed or approved by NAPHDA (Naya Pakistan Housing & Development Authority) or under the ‘Ehsaas Programme’.

(g) “Project” means the construction of a building or a building consisting of apartments, or converting an existing building or a part thereof into apartments, or the development of land into plots, as the case may be, for the purpose of selling all or some of the said apartments or plots or buildings, as the case may be, and includes common areas, development works, improvements and structures thereon, and all easement, rights and appurtenances belonging thereto. Incase, a person develops land and constructs building thereon, the same shall be considered as one project.

(h) “Residential Building” means any building which is not a commercial building but does not include buildings used for industrial purposes.

(i) “Saleable Area” in case of commercial buildings means saleable area as determined by the Approving Authority or Map Approving Authority or NESPAK as per rule 4.

(2) All other expressions used but not defined in these rules shall have the same meaning as assigned to them under the Ordinance.

11.RATE AND COMPUTATION OF TAX LIABILITY.–

(a) Area (A) Karachi, Lahore and Islamabad (B) Hyderabad,

Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, Peshawar, Mardan, Abbottabad, Quetta (C) Urban Areas not specified in A and B

TAX ON BUILDERS FOR COMMERCIAL BUILDINGS

Area in Sq. Ft. Rate/ Sq. ft. Any size Rs.250 Rs.230 Rs.210

FOR RESIDENTIAL BUILDINGS

Area in Sq. ft. Rate/ Sq. ft. upto 3000 Rs.80 Rs.65 Rs.50

More than 3000 & above Rs.125 Rs.110 Rs.100

TAX ON DEVELOPERS FOR COMMERCIAL PLOTS

Area in Sq. Yds. Rate/Sq. Yd Any size Rs.250 Rs.230 Rs.210

FOR RESIDENTIAL PLOTS

Area in Sq. Yds. Rate/Sq. Yd Upto 250 Rs.120 Rs.90 Rs.75

More than 250 & above Rs.150 Rs.120 Rs.100

FOR INDUSTRIAL PLOTS

Area in Sq. Yds. Rate/Sq. Yd Any size Rs.20 Rs.20 Rs.10

(b) In case of ‘Low cost housing’ and all projects developed or approved by NAPHDA the afore said rates shall be reduced by 90%;

(c) In case of development of plots and constructing buildings on the same plots, both rates shall apply: Provided that in the case of ‘low cost housing’ and all projects developed by NAPHDA, the higher rates shall apply.”.

Newspakistan.tv | YouTube Channel